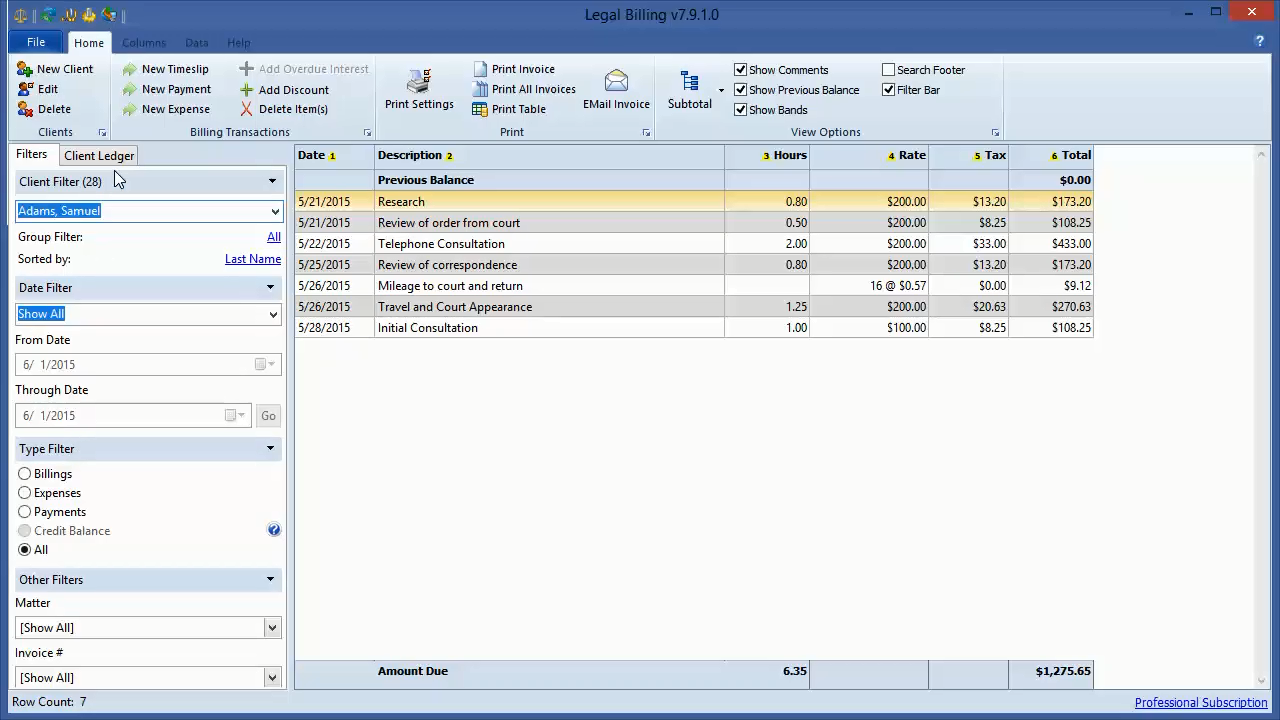

It’s okay to repeat the same phrasing, but the tone and message should feel friendly, calm, and kind. Have a standard but personalized reminder email or letter you can easily send to clients. Identify who needs to follow up on unpaid bills and when. The longer you wait, the less likely your clients will pay, so have a straightforward collections process. Include a standard process for disputes and collectionsĭon’t leave unpaid bills languishing for months. Gaps in communication can cause confusion and delay the payment process. Integrate the finance team with your billing processĮnsure your accountant or finance team knows when your firm is sending bills to clients, what still needs to be collected, and what’s being written off. Be sure to check out our blog post on streamlining your law firm invoice process for further guidance. This helps speed up the process and leaves less room for error-you can even use automation software. It’s helpful to ask lawyers to use a specific system, such as your legal practice management software, to conduct reviews electronically. Giving you momentum to invest in the client-centred experience. This understanding helps support your bottom line, and helps you better understand your clients.

Write out your entire process from start to finish, so there’s no confusion-even if you’re a solo attorney.

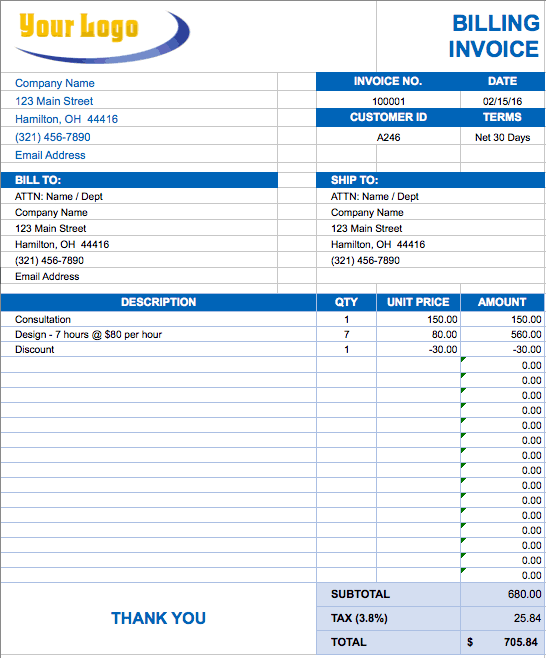

With that in mind, follow these steps to write an effective billing policy: 1. Which stages of the process are causing the biggest bottlenecks.If you’re writing a policy for the first time, you’ll want to consider: It gives lawyers and staff something to refer to and keeps everyone in sync. To save your law firm valuable time and money, having a straightforward, standardized law firm billing policy in place is essential. For example, attorneys taking too long to approve bills or adding too many edits can cause a delay in bills getting sent out. While it seems fairly straightforward, there’s plenty of room for bottlenecks and wasted costs. The accounting team sends follow-up reminders regarding late payments.Clients pay via whatever payment methods are accepted at the firm.A final version of the bill is created and sent to clients for payment.

Attorneys add notes and adjust costs as needed and approve the bill.At the end of each month (or at the end of the case, if it’s a shorter case), bills and expenses for each client and case are put into a draft bill.Billable time and disbursement fees/expenses are logged throughout the case.

0 kommentar(er)

0 kommentar(er)